By evaluating the risks and opportunities presented by climate change and reflecting them in our operational policies and asset management accordingly, we will generate long-term, stable profits.

JRE believes that climate change is more than an environmental issue. We also believe that it bears a major influence on social and industrial structures, and therefore greatly impacts our business activities. To maintain sustainable and stable earnings over the long term and overcome the wave of oncoming changes stemming from climate change, it is important that we evaluate the risks and opportunities that climate change presents, and reflect them in our operational policies and asset management accordingly.

Global Trends

Global Trends in Climate Action

The Paris Agreement is an international framework adopted in 2015 and signed by 197 countries, with the goal of limiting global warming to well below 2℃ above pre-industrial levels and pursuing efforts to limit it even further to 1.5℃. It also aims to achieve net zero greenhouse gas (GHG) emissions by the second half of this century. To achieve these goals, efforts are being made and regulations are being strengthened in many countries and regions and in every industry, aimed at reducing emissions. Furthermore, the possibility of even stronger regulations for reducing emissions has been also discussed.

The fact of the matter is that climate change (global warming) was already underway in the latter half of the 20th century, according to the Intergovernmental Panel on Climate Change (IPCC)*. This is starting to become apparent through a growing frequency of heatwaves as well as heavy rain and other natural disasters. We are expected to respond to these and other physical risks of climate change as a major issue, as they may bear a strong influence on business.

The IPCC Special Report on Global Warming on 1.5℃, published by the IPCC in 2018.

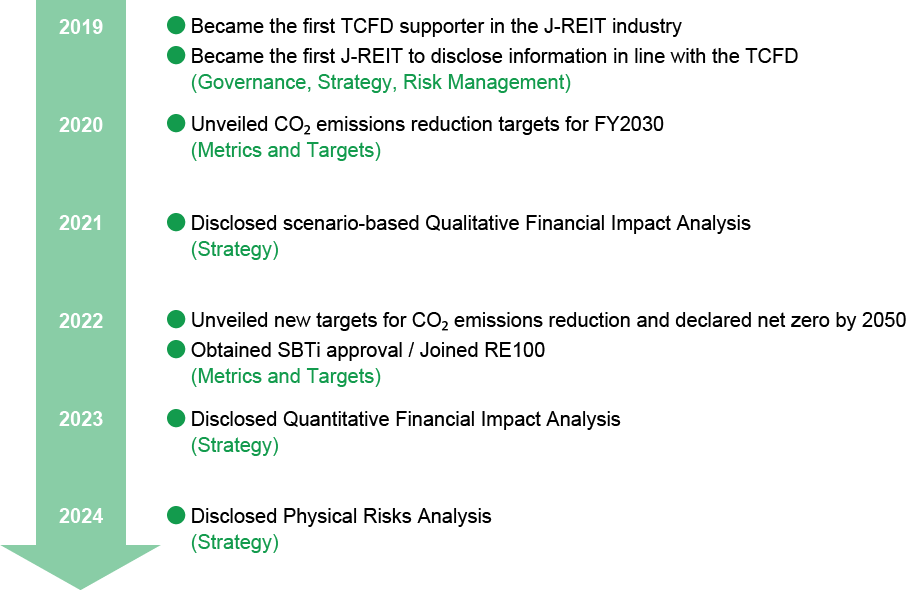

Supporting the TCFD Recommendations

The Task Force on Climate-related Financial Disclosures (TCFD), launched in 2016, has discussed and made recommendations on how financial institutions and companies should disclose information pertaining to the impact that the above effects of climate change will have on business. At present time, the TCFD recommendations have received worldwide support from a great number of financial institutions, companies, investors and governments.

Japan Real Estate Asset Management Co., Ltd., (JRE-AM), which is JRE's asset management company, became a supporter of the TCFD in June 2019. As a supporter, JRE-AM is now evaluating the risks and opportunities that climate change presents to all of our business and promoting to disclose the climate-related information to our stakeholders.

Governance

JRE-AM convenes its Sustainability Committee, chaired by the President & CEO of JRE-AM. The committee determines risks and opportunities related to climate change and investigates and decides on strategies to address these risks and opportunities.

History of JRE’s Approaches in Line with TCFD

Scenario Analysis (TCFD)

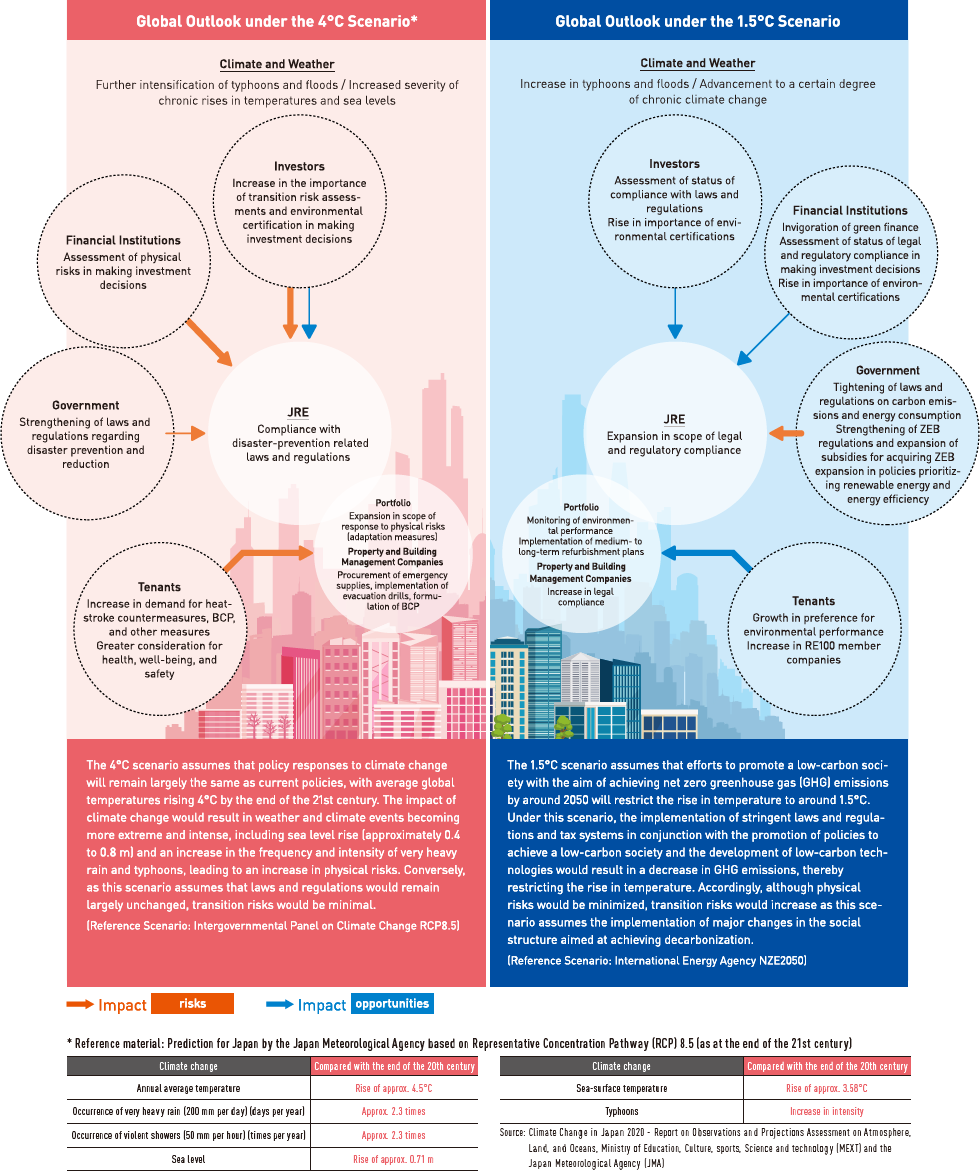

Using scenarios published by international organizations and other entities that predict the impact of global warming and climate change and of the changes that may occur in the business environment as a result of long-term policy trends in relation to climate change, JRE has examined how its businesses could be affected.

For the high resolution image, please click here.

Examination of Financial Impact Based on Scenario Analysis

JRE examined the magnitude of the financial impact of risks and opportunities that it identified for the aforementioned 4℃ and 1.5℃ scenarios.

We examined the impact of each scenario for 2030 (medium-term prospects) and 2050 (long-term prospects) for qualitative financial impact analysis. As for quantitative financial impact analysis, we assumed as of 2050 based on the FY2021 operating profit. The results are as follows.

Qualitative Financial Impact Analysis

Note: Approach to financial impact (minor/moderate/major): Quantitative and qualitative analysis carried out to assess the relative impact.

* Please view the table below while scrolling horizontally.

| Category | Risk and Opportunity Factors | Financial Impact | JRE Initiatives | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Changes in Cash Flow |

Classifi- cation |

4℃ Scenario |

1.5℃ Scenario |

||||||

| Mid- Term 2030 |

Long- Term 2050 |

Mid- Term 2030 |

Long- Term 2050 |

||||||

| Transition Risks and Opportunities | Policy and Legal | Introduction of CO2 emission regulations Adoption of carbon taxes |

Increase in cost of complying with laws and regulations (e.g., carbon taxes, carbon credit purchases) | risks |

Minor | Minor | Moderate | Major |

|

| Introduction of carbon emission-related regulations Introduction of health and well-being regulations Strengthening of energy regulations |

Rise in expense of acquiring environmental certification | risks |

Minor | Minor | Minor | Minor |

|

||

| Enhancement of property competitiveness thanks to complying with laws and regulations | opportunities |

Minor | Minor | Moderate | Major |

|

|||

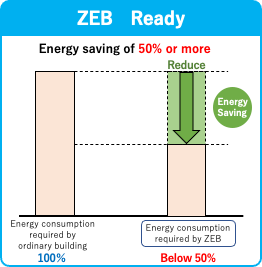

| Technology | Spread of decarbonization technology (Improvement of environmental performance of existing properties) | Increase in costs incurred in procuring ZEB properties and in conducting research on converting properties to ZEBs and installing new technology | risks |

Minor | Minor | Moderate | Moderate |

|

|

| Rise in retrofit costs associated with introducing energy efficient equipment and renewable energy and promoting the carbon neutralization of real estate | risks |

Minor | Minor | Minor | Moderate |

|

|||

| Reduction in utility costs thanks to ZEB conversion and green refurbishments | opportunities |

Minor | Minor | Moderate | Major |

|

|||

| Market and Reputation | Changes in social values regarding environmental performance | Decrease in fund procurement costs through use of green finance | opportunities |

Minor | Minor | Moderate | Moderate |

|

|

| Rise in asset value resulting from improved green performance | Rise in investment appetite of institutional investors thanks to attainment of environmental certifications and acquisition of high ratings from global ratings institutions | opportunities |

Minor | Minor | Moderate | Moderate |

|

||

| Growth in importance of transition risks | Increase in fund procurement costs stemming from a high climate risk assessment | risks |

Minor | Minor | Minor | Moderate |

|

||

| Rise in value of environmental performance | Rise in property value and increase in average rents thanks to the acquisition of environmental certification, such as ZEB and DBJ Green Building Certification | opportunities |

Minor | Minor | Moderate | Major |

|

||

| Changes in tenants’ environmental performance needs | Decrease in earnings resulting from JRE properties becoming stranded assets following a relative decline in their environmental performance | risks |

Minor | Minor | Moderate | Moderate | |||

| Physical Risks and Opportunities | Acute | Increase in typhoons, concentrated heavy rains, floods, and building inundation | Increase in the cost of refurbishments and expense of up-front countermeasures and property insurance premiums stemming from inundation of JRE-owned properties | risks |

Minor | Moderate | Minor | Minor |

|

| Loss of sales opportunities due to inundation of JRE-owned properties | risks |

Minor | Moderate | Minor | Minor | ||||

| Decrease in asset value of properties with a high risk of inundation | risks |

Minor | Minor | Minor | Minor | ||||

| Increase in market competitiveness by maintaining a highly resilient portfolio | opportunities |

Minor | Moderate | Minor | Minor | ||||

| Chronic | Advancement of rise in annual average temperatures | Rise in costs resulting from a growth in demand for air-conditioning | risks |

Minor | Moderate | Minor | Minor |

|

|

| Advancement of rise in sea water levels | Increase in costs incurred for measures to tackle rising sea levels | risks |

Minor | Minor | Minor | Minor |

|

||

Note: BCP: Business continuity planning ; EMS: Environmental management system

Quantitative Financial Impact Analysis

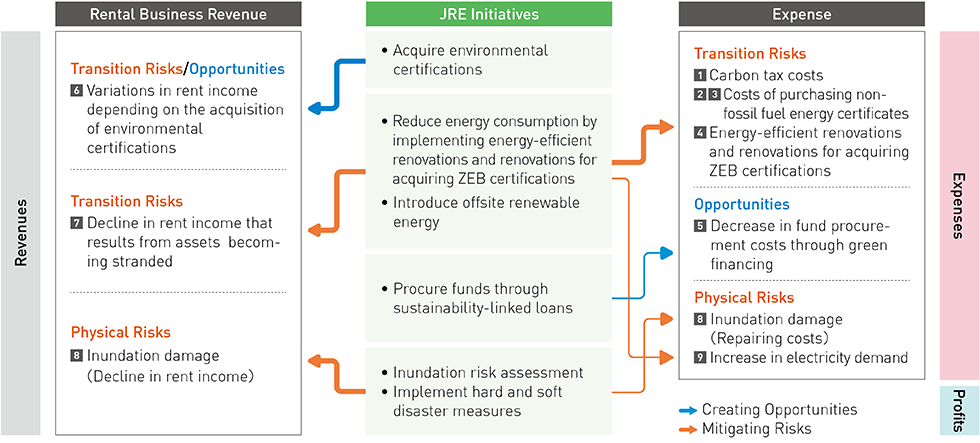

Business Impact of Risks and Opportunities (image)

Estimated Business Impact

1.5℃ Scenario

The effects of JRE’s countermeasures including ZEB initiative and energy-efficient renovations increased operating profit despite the significant impacts of transition risks.

For the high resolution image, please click here.

4℃ Scenario

JRE’s inundation countermeasures avoided the significant impacts of inundation risks, thereby maintaining operating profit.

For the high resolution image, please click here.

In 2023, JRE conducted the physical risks analysis in its quantitative analysis on the basis of maximum expected rainfall (the maximum potential amount of rainfall, occurring at a rate of once every 1,000 years). However, in 2024 it conducted the physical risks analysis on the basis of design scale of rainfall (rainfall on which flood prevention plans, including river maintenance, are based, occurring at a rate of once every 10 to 200 years). Figures have been updated as the latter analysis entailed a reanalysis using a more detailed calculation method.

Estimated Result of Risks and Opportunities

* Please view the table below while scrolling horizontally.

| Category | Risk and Opportunity Factors | Change in Cash Flow | Classifi- cation |

*in hundreds of millions of JPY | Explanation of Calculation | |||

|---|---|---|---|---|---|---|---|---|

| 4℃ Scenario |

1.5℃ Scenario |

|||||||

| Long- Term 2050 |

Long- Term 2050 |

|||||||

| Transition Risks and Opportunities | Policy and Legal | Introduction of CO2 emission regulations Adoption of carbon taxes |

[1] | ◆Changes in the cost of complying with laws and regulations (carbon tax costs imposed on business activities) | Risks |

-0.21 | -15.86 | Significant increase in carbon taxes under the 1.5℃ scenario |

Effects of |

0 | 15.86 | Avoid the imposition of carbon taxes by conducting energy-efficient renovations, introducing renewable electricity, and achieving zero emissions from fossil fuels | |||||

| Technology | Spread of decarbonization technology (Improvement of environmental performance of existing properties) | [2] | ◆Cost of purchasing non-fossil fuel energy certificates for achieving net-zero carbon emissions | Risks |

0 | -3.50 | Procure all electricity used in business activities from renewable energy (by non-fossil fuel energy certificates) under the 1.5℃ scenario | |

Effects of |

0 | 2.10 | Reduce the cost of procuring non-fossil fuel energy certificates by implementing further energy- efficient renovations under the 1.5℃ scenario | |||||

| [3] | ◆Cost of achieving zero emissions from fossil fuels | Risks |

0 | -0.59 | Achieve zero emissions from fossil fuels (by carbon credits) | |||

Effects of |

(0) | (1.98) | Avoid the imposition of carbon taxes *Included in the effects of countermeasures (see [1]) |

|||||

| [4] | ◆Increase in costs incurred through retrofits, such as energy-efficient renovations and renovations for acquiring ZEB certifications | Risks |

0 | -21.10 | Renovation costs for ensuring that 85% of portfolio is certified as ZEB Ready to reflect expectations under the 1.5℃ scenario | |||

Effects of |

0 | 22.89 | Significantly reduce utility costs through renovations | |||||

| Market and Reputation | Changes in social values regarding environmental performance | [5] | Lower fund procurement costs through green finance | Opportunities |

0 | 0.30 | Secure preferential interest rates by procurement of funds through sustainability-linked loans and achieving sustainability performance targets (SPTs) | |

| Rise in value of environmental performance | [6] | ◆Variations in rent income depending on the acquisition of environmental certifications | Risks |

0 | 0 | Achieve environmental certification acquisition rates of 100% under the 1.5℃ scenario | ||

Cost of |

0 | -0.26 | Cost of acquiring environmental certifications | |||||

Effects of |

0 | 30.16 | Command rent premium by maintaining environmental certifications | |||||

| Changes in tenants’ environmental performance needs | [7] | Decrease in rent income that results from assets becoming stranded due a failure to implement countermeasures | Risks |

0 | -64.58 | Decline in rent income that results from assets becoming stranded due to a failure to take action (calculated using the results of CRREM analysis) | ||

Effects of |

0 | 64.58 | Avoid declines in rent income by introducing renewable electricity and achieving zero emissions from fossil fuels to prevent assets becoming stranded | |||||

| Physical Risks and Opportunities | Acute | Increase in typhoons, concentrated heavy rains, floods, and building inundation | [8]-1 | Decline in rent income stemming from flooding at JRE-owned properties (in the event of damage on the expected scale) | Risks |

-0.14 | -0.1 | Decline in rent income in the event of flood damage on the design scale |

Effects of |

0.14 | 0.1 | Avoid damage to facilities by implementing planned flood countermeasures | |||||

| [8]-2 | Facility repair costs stemming from flooding at JRE-owned properties (in the event of damage on the expected scale) | Risks |

-0.4 | -0.29 | Expected flood damage repair costs in the event of flood damage on the design scale | |||

Effects of |

0.4 | 0.29 | Avoid damage to facilities by implementing planned flood countermeasures | |||||

| Chronic | Advancement of rise in annual average temperatures | [9] | ◆Rise in electricity charges due to higher temperatures in summer | Risks |

-0.36 | -0.16 | Increase in electricity consumption due to a rise in annual average temperatures | |

Effects of |

0 | 0.08 | Reduce electricity consumption by implementing energy-efficient renovations and renovations for acquiring ZEB certifications | |||||

◆ Reflects forecasted future increases in assets under management

Figures for risks include costs for implementing proactive countermeasures, such as converting properties to ZEBs

This estimate is an analysis of part of JRE’s business and does not assess the overall impact. We will continue to examine the approach to assumptions in estimated items and expand estimated items based on the policy trends in the world and Japan in order to further deepen our analysis.

In addition, we conducted an analysis referencing a Ministry of Land, Infrastructure, Transport and Tourism (MLIT) manual for risks related to inundation at JRE-owned properties (discussed later).

This estimate is made based on JRE’s actual performance and refers various parameters such as scenarios and reference materials presented by major organizations. The amount of financial impact is an annual basis. No assurances are provided on the accuracy thereof. Furthermore, the assumed measures are estimated assumptions, and no plans or decisions have been made to execute them.

Analysis using CRREM’s risk assessment tool

< Overview of CRREM >

CRREM (Carbon Risk Real Estate Monitor) calculates and publishes GHG emissions pathways (carbon reduction pathways) up to 2050 consistent with the 2℃ and 1.5℃ targets of the Paris Agreement for each use of real estate in a total of 44 countries (as of September 2025) in Europe, North America and the Asia-Pacific region, including Japan. This tool is expected to be utilized for operational improvement by comparing the property data analyzed and pathways to calculate the timing of assets becoming stranded and carbon costs for each property, and to grasp the scale of renovation required to address these issues.

JRE has targeted the properties owned by JRE (as of March 2022) and analyzed the potential stranded asset risk of the portfolio using CRREM’s risk assessment tool. The analysis is based on the Asia-Pacific version of the tool (ver. 1.22) and global pathways (ver. 2.01). JRE will use this analysis to make our business strategies, including renovation, disposition of properties and other initiatives.

Climate Change-Related Risks and JRE's Response

Transition Risks

The government of Japan and local municipalities are already making moves to tighten regulations as a measure against climate change. If policies, laws, and regulations are strengthened to keep within the 1.5℃ or 2℃ global temperature limit stated in the Paris Agreement or to achieve net zero GHG emissions by 2050 in Japan, there are concerns that the outcomes, including regulations on GHG emissions that extend to Japan, regulations on energy-saving capabilities for buildings, and the introduction of carbon taxes, could have various impacts on the real estate business.

Moreover, as we make the move toward a decarbonized society, there is the belief that tenants of office buildings will be incentivized to reduce energy consumption and GHG emissions in their rental spaces. These incentives could change conditions in the office market.

Financial institutions and investors are also incorporating the climate-related risks of their investment targets into their investment processes. This may have an effect on business' procurement of funds.

To address these "transition risks," JRE is promoting a variety of specific measures and actions, such as Green Projects that reduce GHG emissions or improve energy efficiency, and obtaining environmental certifications.

JRE’s specific measures are as follows.

1. Reduction of CO2 emissions

To respond to the future possibility of even stronger regulations for reducing emissions, such as obligation to reduce total emissions or introduction of carbon taxes, JRE has set a reduction target for its entire portfolio (80% reduction by FY2030/ Base year: 2019)

2. Reduction of CO2 emissions intensity

Rising awareness on climate change risks has been appearing in not only the real estate industry but in every industry around the world. Also, an increasing number of office building tenants have started to make efforts to address climate change as an important issue. JRE believes that with this trend in the market, properties with high CO2 emissions will decrease their values while properties with high energy efficiency will increase their values.

By FY2030, JRE aims to reduce the average carbon intensity of its entire portfolio to 12 kg-CO2/m² or lower as well as own 5-10 Net Zero Energy Buildings (ZEBs).

We believe improving energy efficiency of each asset will prevent it from becoming a “stranded asset”, but increase its value in the market. We will pursue higher profits through appealing our high-performance green buildings such as ZEB properties to our tenants.

Physical Risks

Due to its geographical circumstances, Japan experiences typhoons and heavy rain every summer and an accumulation of snow in the winter. This, in conjunction with its susceptibility to earthquakes, classifies Japan as a country prone to many natural disasters. As global warming continues on a global scale, there is a possibility that these disasters will become more numerous and severe, with a greater financial impact. These "physical risks" brought on by major climate change are cause for global concern.

In order to mitigate risks toward the profitability of its portfolio as a result of disaster-related damages, JRE employs a strategy to minimize damage in the event of a disaster, and to increase resilience against the growing severity of these disasters.

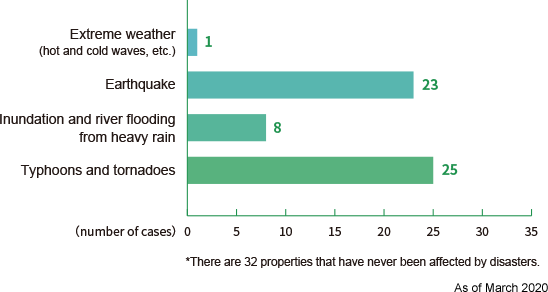

Resilience of JRE Portfolio According to Past Cases of Disasters and Data

Japan is a country that experiences numerous natural disasters. Over the past 10 years, Japan has been struck by several catastrophic disasters, such as the 2011 Great East Japan Earthquake (earthquake and tsunami), the Heavy Rain Event of July 2018 (heavy rain and inundation), the 2018 Hokkaido East Iburi Earthquake (earthquake, landslides and wide-ranging power outages), Typhoon Faxai (strong winds, house damage and long-term power outages), Typhoon Hagibis (heavy rain, river collapse and inundation) in 2019, and the 2024 Noto Peninsula Earthquake (earthquake and house damage).

JRE’s portfolio has not been exempt from these disasters and several properties have been affected by these disasters in some way, but due to the resilience of the buildings and the strong response from PM companies, the hard and soft damage to these buildings has been limited.

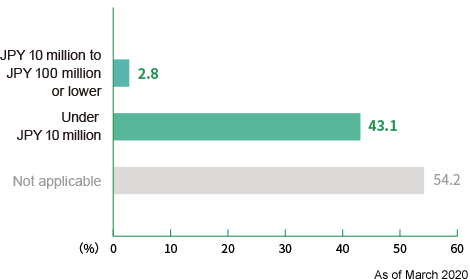

Types of Disasters that Have Caused Damage in the Past * (number of cases)

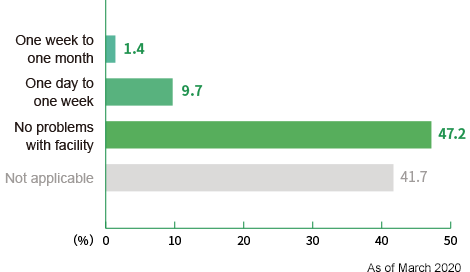

Even when a disaster occurs, buildings are restored to full function within one week in almost all cases, with repairs costs under JPY 10.0 million.

Past performance has proven JRE's portfolio to be sufficient, even when considering the above-mentioned natural disasters that often occur in Japan.

JRE employs hard and soft measures to address various disasters and accidents that include regular building safety management checks by the PM, running drills for different kinds of disasters, stockpiling emergency supplies and food, implementing disaster training with the cooperation of tenants, and maintaining a disaster prevention council.

Time Required for Post-Disaster Building Repairs (%)

Repair Costs (%)

In addition, there is only 1 example of a building becoming inoperable (closed, etc.) due to a disaster.

8・3 Square Kita Building was closed as result of large-scale power outages lasting about two days stemming from the 2018 Hokkaido Eastern Iburi Earthquake that occurred in the summer of that year. The building was closed as a result of the power outage, with no damage to the building. On the day of the event, on-site staff responded appropriately and promptly to ensure that all tenants and visitors in the building were evacuated smoothly, and were successful in their efforts.

Furthermore, there was no loss of profits as a result of the building closing. Despite the difficulty in gathering information due to the power outage, JRE was able to get an accurate and timely grasp of the local response and provide a release on the disaster situation, as its system for understanding such situations was functioning normally.

Future Risk Forecast

Analysis of JRE’s Portfolio Based on Municipal Hazard Map

In recent years, typhoons around the Japanese archipelago have been increasing in size. In addition, river flooding and inundation have been occurring frequently due to typhoons and heavy rains. Damages due to inundation are predicted by the hazard maps of each local government. These maps are believed to have high accuracy when compared against actual disaster occurrence.

The graph below outlines expected inundation for JRE's portfolio.

84% of buildings in the portfolio fall under the category of “No inundation expected” (based on the total number of buildings).

JRE conducts hard measures, such as installation of water-stopping plates, and soft measures, such as training on how to stop inundation, at all buildings where inundation is expected.

* Please view the table below while scrolling horizontally.

| Number of properties | Number of properties with risks | Percentage of properties with risks | Percentage with water-stopping plates | Percentage with BCP countermeasures |

|---|---|---|---|---|

| 77 | 12 | 16% (based on the total number of properties) |

100% | 100% |

| As of March 2024 |

JRE also focuses on risks due to rising sea levels, identifying potential risks based on projections of rising sea levels and the location of properties.

Expected Inundation According to Design Scale Flood

“Hard” Measures at Buildings to Address Natural Disasters (Typhoons, Heavy Rain)

To address flooding caused by typhoons and heavy rain, which affect Japan due to geographical factors, we have taken “hard” measures at buildings that include installing water-stopping plates in building apertures, preparing sandbags and water-stopping sheets, and installing water-proofed doors for underground rooms with important equipment.

“Soft” Measures for When Disasters Occur

Disaster countermeasures and training appropriate to each type of disaster are implemented by the top-class PM companies in Japan.

In addition, appropriate “soft” measures have been taken, which include holding disaster prevention council meetings with tenants, distributing BCP manuals, and introducing a system between JRE-AM and PMs to gain understanding of disaster situations.

Overview of Physical Risks Scenario Analysis

To identify medium- to long-term risks, JRE conducted detailed calculations of direct damage (the physical damage to buildings) due to inundation and indirect damage (damage due to stoppage of the operation of buildings).

Details of conditions, referenced materials, and analysis flow in the calculations are as follows.

* Please view the table below while scrolling horizontally.

| Category | Conditions, etc. | Materials referenced |

|---|---|---|

| Analysis framework | Damage amount taking into account expected depth of inundation when rivers overflow | A Guide to Flood Risk Assessments for Enhanced TCFD Disclosures (MLIT, 2023) |

| Inundation scenario | Design scale of rainfall | Hazard Map Portal Site |

| Assessment timeframe | Medium term, long term, and at the end of the 21st century | ― |

| Climate change scenario |

Takes into account the progression of climate change for each timeframe (Rising temperature scenario) SSP1-1.9, 5-8.5 (inundation frequency*) 2℃ increase scenario: double 4℃ increase scenario: quadruple Changes from around 1951 to 2010 |

IPCC AR6 Synthesis Report Policy Recommendations on Flood Control Planning Under Climate Change, Revised Edition (MLIT, 2021) |

| Portfolio | As of fiscal 2023 year-end | |

Analysis Flow

- Verify hazards by property when inundation occurs

- Calculation of current damage, amount taking into account depth of inundation

- Calculation of damage by assessment timeframe, taking into account depth of inundation for each climate change scenario

- Assess risks for entire portfolio

Calculation results are as follows.

Future Forecast of Direct Damage

Key (colors)

Red: 4℃ scenario, Blue: 1.5℃ scenario

Key (graph)

Solid line: Damage amount based on best temperature increase estimate

Color width: Range of damage amount based on low increase in temperature / high increase in temperature

Total Potential Damage Amount for Properties at Risk of Inundation

| Scenario | Timeframe | Direct damage amount (millions of JPY/year) |

Indirect damage amount (millions of JPY/year) |

|---|---|---|---|

| 4℃ | At present | 23.3 | 8.1 |

| 2030 | 29.2 | 10.1 | |

| 2050 | 40.3 | 14.0 | |

| End of 21st century | 77.4 | 26.9 | |

| 1.5℃ | At present | 23.3 | 8.1 |

| 2030 | 27.9 | 9.7 | |

| 2050 | 29.2 | 10.1 | |

| End of 21st century | 26.7 | 9.3 |

The analysis is based on JRE’s portfolio in fiscal 2023; it does not take into account future property acquisitions. JRE will continue to implement countermeasures at properties it acquires, including installing water-stopping plates, preparing sandbags and water-stopping sheets, and installing waterproof doors for underground rooms with important equipment.

Provisional calculation for when inundation occurs. It does not determine the future damage amount.

JRE's Approaches toward Climate Change Opportunities and JRE's KPI

While climate change presents business risks, it also provides opportunities for social economic reform and value-add approach for the business. JRE is driving the below strategies to increase value and to seize REIT growth opportunities in terms of internal growth, external growth, and financial strategy.

Internal Growth Opportunities

Effective CAPEX (capital expenditure) Control/Internal Carbon Pricing

1. Effective CAPEX Control

JRE-AM, which is JRE’s asset management company, has a dedicated engineering team (Construction Management Office), which is engaged in efficiently controlling CAPEX and refurbishment works of over 70 properties. Furthermore, we collaborate with the engineering team of Mitsubishi Jisho Design Inc., which is one of the leading architectural firms in Japan, to conduct technical assessments of our properties, review lifecycle costs of the existing properties, and control costs.

2. Internal Carbon Pricing

JRE has introduced an Internal Carbon Pricing (ICP) system which promotes reduction of environmental burden by converting the amount of CO2 emissions to cost virtually. JRE will further accelerate energy-efficient investments that lead to achieve Net Zero by 2050.

【Overview of JRE's ICP System】

| Internal Carbon Price | JPY 20,000 / t-CO2 |

|---|---|

| Target | Energy-efficient renovations that reduce CO2 emissions (air conditioning and LED upgrades, etc.) |

| Method | When the amount of CO2 emissions reduced by energy-efficient renovations (air conditioning and LED upgrades, etc.) is clear, we apply our internal carbon price to that amount as a reference to decide whether to undertake these renovations. |

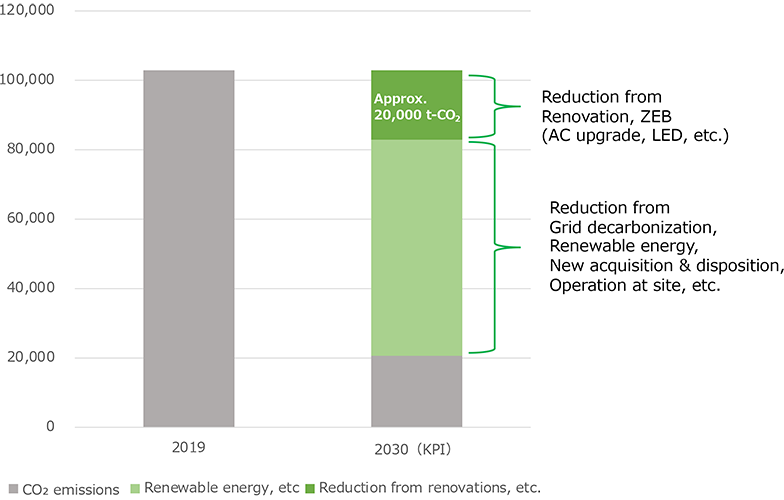

3. Roadmap for CO2 Emissions Reduction by FY2030

(1) CO2 Emissions Reduction Roadmap Concept

JRE aims for 80% reduction of CO2 emissions by FY2030.

The breakdown of the reduction is shown in the bar chart above. We expect 20,000 t-CO2 / year reduction mainly from renovation of existing buildings and ZEBs.

The reduction through renovations and ZEB properties above is supported by the engineering study conducted by Mitsubishi Jisho Design Inc. We conducted theoretical scenario analysis supported by the extensive track record of renovations of Mitsubishi Jisho Design Inc., as well as studies based on the on-site inspections. The study results are as follows (comparison of the same property):

* Please view the table below while scrolling horizontally.

| Case Ⅰ | Case Ⅱ | Case Ⅲ | |

|---|---|---|---|

| CO2 Reduction (t-CO2) | 21,944 | 26,667 | 28,637 |

| Extra cost | No additional cost | JPY 1.1 billion | JPY 3.2 billion |

Based on the above results, JRE will work on the way between Case II and Case III. When carrying out renovation work on individual property, not only will we simply refurbish aging facilities and work on energy efficiency but we will also strive to further improve profitability by increasing the total value of our property, while considering the needs of tenants and customers (please refer to the case study below).

LED conversion work

JRE has already made a strategy and budget for LED upgrade for the entire portfolio and has been promoting a shift to LED.

We believe not promoting a shift to LED has a greater risk for us as manufacturers will stop their production of the existing fluorescent tubes in the future. The budget to be implemented by FY2030 is approximately JPY 7 billion.

For more information, please see the Mitsubishi Jisho Design Inc. CO2 Reduction Study Report.

-

FY2019

MJD Study Report -

FY2020

MJD Study Report -

FY2022

MJD Study Report -

FY2023

MJD Study Report -

FY2024

MJD Study Report

(2) Benefits from Energy Reduction

Annual total CO2 emissions from our portfolio are approx. 100,000 t-CO2 and electricity is about 78% of our energy consumption (based on FY2018 results). The total electricity consumption is approx. 200 million kWh. 35% reduction of electricity will contribute to cost reduction as follows:

200 million kWh /year × 35% (reduction rate) × @ JPY 16.8 /kWh ≒ Approx. JPY 1.176 billion /year

Almost half of the above total electricity is consumed and paid by our tenants, and even if that amount is excluded, JPY 500 million or more will contribute to our profits.

(3) Proactive Introduction of Renewable Energy

JRE accelerates the use of electricity made from renewable energy recognized by RE100* ("renewable electricity"). For more details, please refer to the related information.

(4) Grid de-carbonization (Emissions reduction target by the electric power industry)

The government and the Electric Power Council for a Low Carbon Society have set a CO2 emission factor target for 2030 of 0.370 kg-CO2/kWh(the target was se in 2015).

JRE will conservatively consider the contribution of this reduction from grid de-carbonization based on the consensus of public opinions in the future.

Asset-level renovation project and value-add approach (case study)

While improving the energy efficiency of individual buildings serves as an advance response to the transition risk of reducing GHG emissions, it also serves as an opportunity to improve profitability by increasing NOI via savings of utility costs and raising appeal for environmentally conscious tenants.

JRE is reducing utility costs by upgrading to LED lightings. Furthermore, we are moving forward with asset-level green refurbishment project, including Ginza Sanwa Building and JRE Shiba 2Chome Daimon Building. These projects receive a green premium after conferring with tenants comprising increased rent and payment into a cooperative green fund, resulting in lower emissions and higher profitability.

Future ZEB achievements in JRE portfolio

JRE aims to own 5–10 ZEBs by 2030 (including Nearly ZEB, ZEB Ready, and ZEB Oriented buildings). In collaboration with Mitsubishi Jisho Design Inc., we have started to verify the future possibility to make the existing properties into ZEBs through renovations. We acquired ZEB Ready Certification for JRE Higashi-Gotanda 1Chome Building in 2021, for Daido Seimei Niigata Building in 2022, and for JRE Kayabacho 2Chome Building in 2023, acquiring ZEB Oriented Certification for JRE Yoyogi 1Chome Building in the same year. These are the acquisitions of ZEB Certification by application at the design stage based on the assumption of renovation work in an existing building. JRE will continue to promote its ZEB initiatives in order to achieve its KPIs.

Please click here for the properties with ZEB Certification.

For more information, please see the Mitsubishi Jisho Design Inc. Study Report.

-

FY2019

MJD Study Report -

FY2020

MJD Study Report -

FY2022

MJD Study Report -

FY2023

MJD Study Report -

FY2024

MJD Study Report

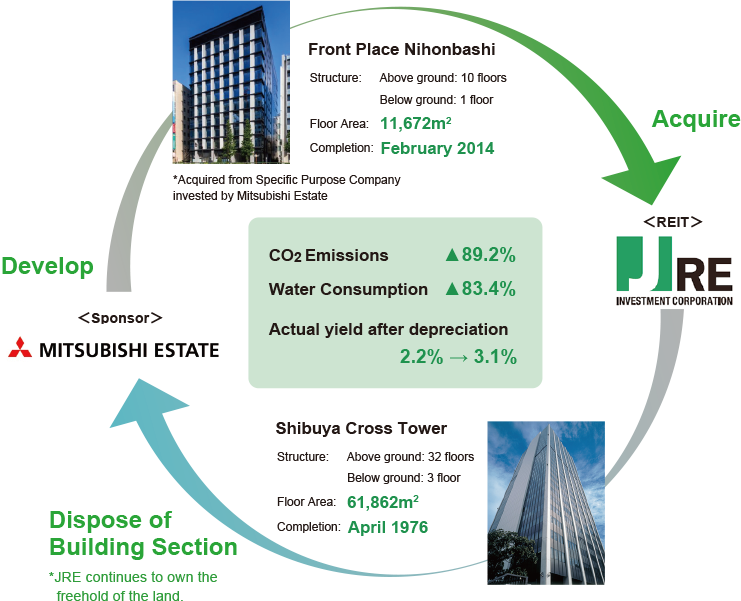

External Growth Opportunities

With the cooperation of JRE-AM's sponsor, Mitsubishi Estate Co., LTD., we continue to build a portfolio that balances profitability with adaptability to a decarbonized society, by leveraging property replacements and mutual tradings to replace older properties with newly constructed buildings with high energy efficiency.

Example of property replacement with sponsor:

January 2018 Disposed: Shibuya Cross Tower (building section) ←→ Acquired: Front Place Nihonbashi

As the above transaction was made during the fiscal 2017, comparative data has been calculated for the following period for each. Shibuya Cross Tower: CO2 emissions and water consumption for fiscal 2016 Front Place Nihonbashi: CO2 emissions and water consumption for fiscal 2018

Financial Strategy Opportunities

As the financial impact of climate change comes increasingly to light, it is likely that financial institutions and investors will place more focus on green financing. As a green investment and lending target, JRE developed a green bond framework and has been promoting green financing as a means to acquire advantageous funding opportunities.

To ensure that our green commitment can be objectively verified, we are making use of DBJ Green Building Certification, BELS certification, and other certifications, establishing a system for evaluating and measuring positive impacts on the environment and society, and also actively reporting to external parties.

In November 2018 JRE issued green bonds (Japan Real Estate Investment Corporation 12th Unsecured Bond)

JRE Investment Corporation Bonds (Green Bonds) won bronze at the Ministry of the Environment’s inaugural ESG Finance Awards in February 2020. For more information, please see the news release.