Management System

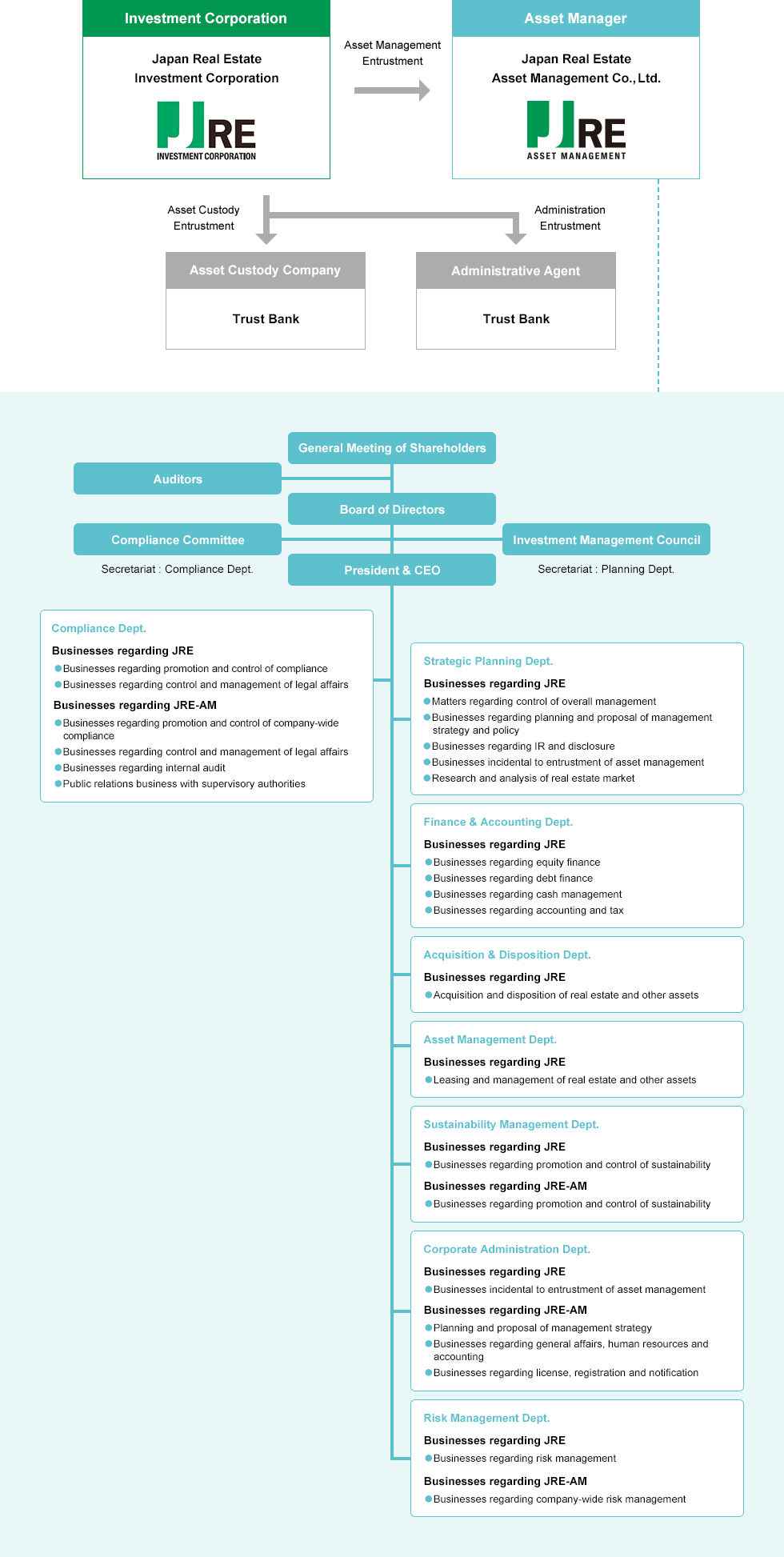

Japan Real Estate Investment Corporation (JRE) entered into an entrustment contract for asset investments with Japan Real Estate Asset Management Co., Ltd. (JRE-AM). JRE has also entered into business consignment contracts with various trust banks for custodial business related to assets and general business outsourcing. Under the management structure below, JRE-AM conducts asset investments such as acquisition and transfer of properties and leasing spaces to tenants.

For details, please refer to the securities report (Part 2. Details of JRE, Section 4. Status of affiliates, 1. Outline of JRE-AM, (2) Operation system (available only in Japanese).