Japan Real Estate Investment Corporation (JRE) is committed to endeavoring to enhance consideration towards the environment, social contributions and corporate governance to improve the sustainability of society. We recognize that this is an important social responsibility for a listed enterprise to assume, and also believe that it is essential for maximizing our unitholder value.

To put our commitment into practice based on the above recognition, Japan Real Estate Asset Management Co., Ltd. (JRE-AM), JRE’s asset management company, has established its Sustainability Policy to communicate its priority issues and basic policies on sustainability with regard to its real estate investment management. Under the Policy, we implement various initiatives, including environmental impact reduction through facility upgrades and acquisition of Green Building certifications, as well as contribution actions to the local communities.

For the commitment made by the top executive of the asset management company, please click here.

Sustainability Policy

1 Climate change initiative (promoting decarbonization and strengthening resilience)

In order to make the move toward a decarbonized society, we will reduce GHG emissions through proactively introducing energy efficient equipment and renewable energy. Also, we will strengthen the resilience of our portfolio against the growing frequency and severity of natural disasters.

2 Contribution to resource conservation including water and resource recycling

We will protect and conserve water through introducing water saving equipment as well as promoting water reuse. For the sustainable use of resources, we will reduce waste (3R: Reduce, Reuse, Recycle) including plastic consumption.

3 Contribution to conserving biodiversity and ecosystem

We will conserve biodiversity and ecosystem in such a way as to select and manage native plant species.

4 Enhancement of tenants' health and well-being, and safety

We will realize “offices of tenants' choice" through collaborating with our stakeholders such as property management companies.

5 Creating a workplace where a diverse workforce can thrive

We will provide education and training programs for officers and employees to raise ESG awareness and build capacity, as well as support a diverse human workforce and flexible work styles to meet individual lifestyles. We will also create an employee-friendly workplace considering employee's health and well-being.

6 Enhancement of governance systems

We will enhance our governance systems with an aim to maximizing our unitholders value through complying with laws, regulations, and rules as well as ensuring appropriate management of conflicts of interest.

7 Stakeholder engagement through information disclosure and ESG evaluations

We will endeavor to disclose ESG related information based on the various ESG reporting frameworks to each of our stakeholders including our investors, thereby promoting constructive dialogue with them.

As stated above, we will develop sustainability promotion systems and reflect risks and opportunities that ESG presents in our business strategies.

Materiality

Based on the Sustainability Policy, JRE and JRE-AM have determined materiality in order to achieve a sustainable society under our corporate social responsibility, recognizing the importance of consideration for ESG. We will annually disclose the progress of KPIs linked to the each objective and work towards contributing to the Sustainable Development Goals (SDGs) as well as achieving medium- to long-term growth of JRE through our responses to materiality.

| Materiality, Objective and Target | Supporting SDGs | ||

|---|---|---|---|

| Enviroment E |

Climate Change Initiative |

|

|

| Objective |

|

||

| KPI |

|

||

| Target |

|

||

| Reported Location | |||

| Conservation of Water Resources |

|

||

| Objective |

|

||

| KPI |

|

||

| Target |

|

||

| Reported Location | |||

| Recycling and Conservation of Resources |

|

||

| Objective |

|

||

| KPI |

|

||

| Target |

|

||

| Reported Location | |||

| Environmental Consideration of Portfolio |

|

||

| Objective |

|

||

| KPI |

|

||

| Target |

|

||

| Reported Location | |||

| Social S |

Tenant Engagement |

|

|

| Objective |

|

||

| KPI |

|

||

| Reported Location | |||

| Human Resources Development and Diversity Promotion |

|

||

| Objective |

|

||

| KPI |

|

||

| Reported Location | |||

| Employee Health and Well-being at JRE-AM |

|

||

| Objective |

|

||

| KPI |

|

||

| Reported Location | |||

| Governance G |

Enhancing Governance Systems at Both JRE and JRE-AM |

|

|

| Objective |

|

||

| KPI |

|

||

| Reported Location | |||

| Information Disclosure and Stakeholder Engagement |

|

||

| Objective |

|

||

| KPI |

|

||

| Reported Location | |||

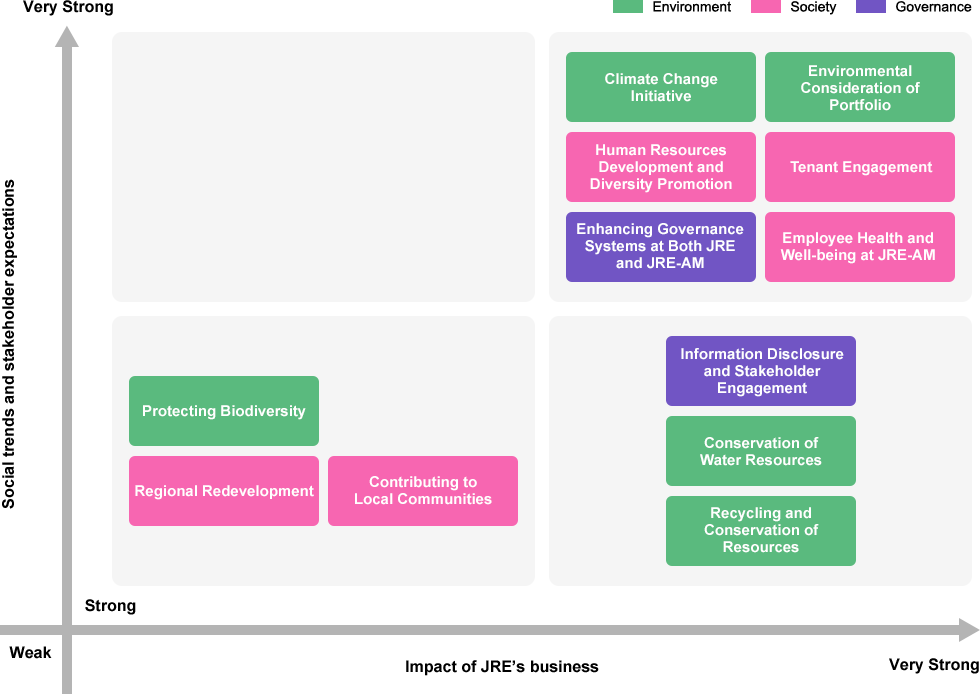

Identifying Process on Materiality

STEP1 : Selection of Issues to Be Considered

We have selected and proposed a wide range of topics from the perspectives of a variety of stakeholders within and outside the JRE. This selection was made in reference to the various guidelines and evaluation criteria specified by ESG rating agencies such as SASB Standards, GRI Guidelines, MSCI, FTSE, GRESB and CDP, as well as the status of initiatives undertaken by our peers in the same industry.

STEP2 : Prioritization of Proposed Topics

We have prioritized the proposed topics and created a materiality matrix in terms of their importance to stakeholders and their impact and importance to JRE.

Materiality Matrix

STEP3:Discussion, Confirmation of Appropriateness and Approval on the Management level

Having determined their priorities, we have discussed these issues at the Sustainability Committee and officially positioned them as JRE’s Materiality based on the advice from two ESG experts.

Please click here for the discussion for setting up JRE’s Materiality.

Finally, JRE’s Materiality was approved at the Investment Management Council of JRE-AM and is to be reported to the Board of Directors of JRE.

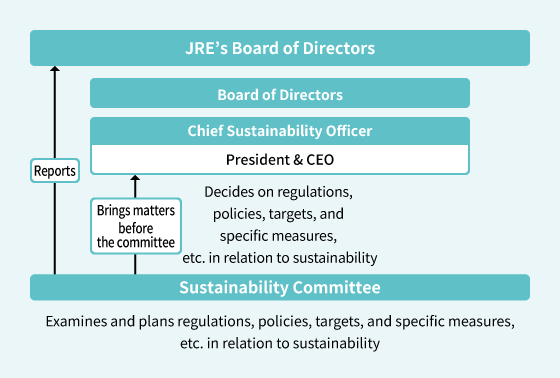

Sustainability Committee

Japan Real Estate Asset Management (JRE-AM ) convenes its Sustainability Committee with a view to implementing the Sustainability Policy in order to improve sustainability and maximize its unitholder value.

Members of the committee:

President & CEO (Chief Sustainability Officer)

General Manager, Sustainability Management Department (Sustainability Officer)

General Managers of other departments and those practically in charge of sustainability at each department

Meeting frequency and decision-making process:

The Sustainability Committee meets four times a year in principle. The committee strives to continuously improve sustainability initiatives by executing a PDCA cycle to examine and plan regulations, policies, targets, and specific measures in relation to sustainability, decide on and implement measures based on JRE-AM’s job responsibilities and authority regarding the matters planned, report and evaluate the progress and analysis results, and then examine and plan improvement actions.

In addition, the committee reports on the regulations, policies, targets, and specific measures to JRE’s Board of Directors once a year.