JRE and Japan Real Estate Asset Management Co., Ltd. (JRE-AM), JRE’s asset management company, attaches great importance to ESG-friendly management as a means to continuously improve asset value, and has become signatory to and participated in the following initiatives.

Initiatives

JRE and JRE-AM has become a signatory to the following initiatives and participated in UNGC based on the idea that asset management considering ESG is essential to the sustainable growth of the asset value.

- Obtaining of Science Based Targets initiative (SBTi) Approval

- Joining RE100

- Signatory to PRI

- Participation in UNGC

- Participation in Japan Climate Initiative (JCI)

- Signatory to the Principles for Financial Action for the 21st Century

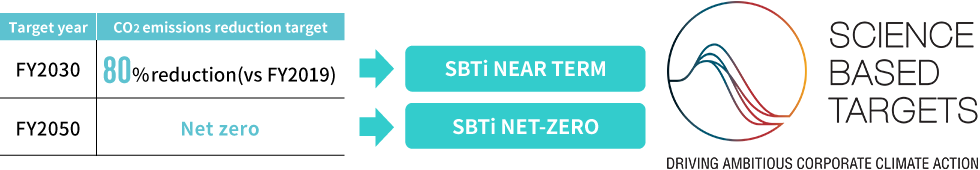

Obtaining of SBTi Approval

The SBTi is a global joint initiative by CDP, the United Nations Global Compact, the World Resources Institute (WRI) and the World Wide Fund for Nature (WWF), established in 2015. It promotes the validation and certification of science-based GHG emissions reduction targets set by private companies to achieve the goal upheld at the Paris Treaty (limiting global warming due to climate change to below 2°C compared with pre-industrial levels).

JRE’s CO2 Emissions reduction targets were approved by the Science Based Targets initiative (SBTi).

Joining RE100

RE100 is the global corporate initiative led by The Climate Group in partnership with CDP which aims to procure 100% of electricity used in business activities from renewable energy.

JRE aims to make 85% of electricity used at our buildings renewable electricity by 2025, 90% by 2030 and 100% by 2050, and it joined RE100 as the first J-REIT in 2022.

Signatory to PRI

PRI comprises an international network of investor signatories that works to realize the Six Principles established for the finance industry in 2006 under the leadership of the then United Nations Secretary-General, Kofi Annan. This network is promoted through the United Nations Environment Programme (UNEP) and the United Nations Global Compact (UNGC).

PRI encourages the incorporation of Environment, Social and Governance issues into investment decision-making processes, with the aim to help companies enhance long-term investment performance and better fulfill their fiduciary duty.

JRE-AM agreed with the basic approach of PRI and became a signatory in August 2018.

- We will incorporate ESG issues into investment analysis and decision-making processes.

- We will be active owners and incorporate ESG issues into our ownership policies and practices.

- We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- We will promote acceptance and implementation of the Principles within the investment industry.

- We will work together to enhance our effectiveness in implementing the Principles.

- We will each report on our activities and progress towards implementing the Principles.

Participation in UNGC

UNGC is a voluntary, global initiative supporting a global framework for sustainable growth through the demonstration of creative, responsible leadership by the respective corporations and organizations as principled members of society.

First proposed in 1999 by the then United Nations Secretary-General Kofi Annan, it engages in activities based on ten universally-accepted principles in the four areas of human rights, labor, environment, and anti-corruption.

Mitsubishi Estate Co., Ltd. became a signatory of the UNGC and Mitsubishi Estate Group was registered as participants in April 2018. Along with this, JRE-AM has participated in this initiative as a member of Mitsubishi Estate Group.

Participation in Japan Climate Initiative (JCI)

The JCI is a diverse network of non-state actors, such as Japanese companies, local governments, organizations, and NGOs, actively engaged in climate action. JRE-AM joined the JCI in September 2022.

Signatory to the Principles for Financial Action for the 21st Century

In June 2019, JRE-AM became a signatory to the Principles for Financial Action for the 21st Century, which were formulated in October 2011, with the Ministry of Environment serving as secretariat, as guidelines for action by financial institutions seeking to fulfill their roles and responsibilities necessary to create a sustainable society.